Some of the biggest companies in the world such as Facebook, Twitter, Youtube and Tiktok started as social networks and their ability to capture value can be directly derived from the size and quality of their social graphs.

Social graphs are networks of user identities that relate to one another via standardized social data such as follows, likes, comments, favourites, bookmarks, friends, topics and more.

For example:

Facebook’s graph revolves around mutual friends, originally seeded from university campuses. Over time, it evolved to link people based on real-life social connections. The network effect grew rapidly as each new user’s circle of friends generated more engagement, personal data, and content, reinforcing Facebook’s position as the go-to platform for family, friends, and community interaction.

Reddit’s graph centers on communities formed around topics. Instead of linking individuals through friendships, Reddit organizes people by their interests in specific “subreddits.” Upvotes, downvotes, and comment threads determine content visibility, creating a self-curated feed driven by shared passions rather than personal connections.

Twitter’s graph is heavily driven by followers and an asymmetrical follow model. People can subscribe to someone else’s posts without reciprocity. This structure encourages open discourse, real-time reactions, and viral sharing, making Twitter a powerful social network for breaking news, public conversation, and influencer-driven trends.

Being able to build on top of a rich social graph is the single biggest catalyst for any app to solve the cold start problem as well as a big revenue driver for the social graph itself.

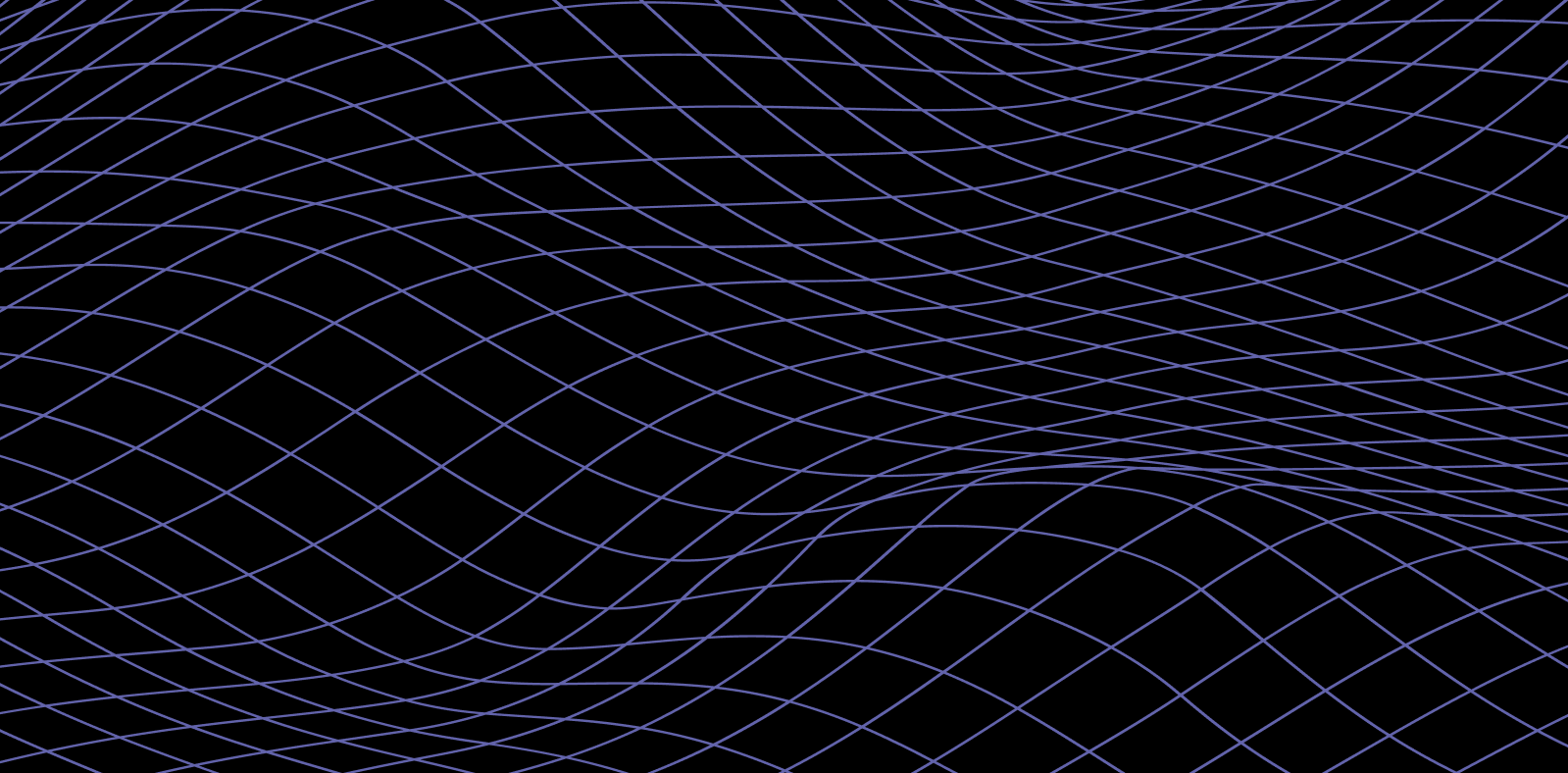

The most successful social apps of the Web2 era didn't grow in isolation

These companies scaled by integrating with existing social graphs, gaining immediate access to user identity, trust, and viral distribution. Zynga reached 10 million MAUs within six weeks by leveraging Facebook’s social infrastructure, while Spotify used Facebook login and sharing features to boost time on site and referral growth. These partnerships created strong mutual benefit, driving growth for the apps while increasing engagement, data richness, and monetization opportunities for the social graphs hosting them.

A defensible social graph rests on deeply strong network effects, proprietary behavioral data, mutual dependence of creators and consumers, and a broad ecosystem of integrations. Every new connection not only enriches an individual user’s experience but also amplifies the value of the entire network, while the content you share and the groups you join build a detailed profile that cannot be replicated overnight. As audiences grow, they attract more creators, and advertisers compete for access to finely segmented audiences, cementing a two‑sided lock‑in that makes it extremely costly for any participant to jump ship. Meanwhile, third‑party games, applications and analytics tools that rely on a platform’s social login, sharing widgets and data hooks become inseparable from that graph: moving to another network would require re‑engineering their entire technology stack.

Yet even when a partner drives massive revenue, social graphs may choose to block access. For example, Zynga titles generated nearly one‑fifth of Facebook’s ad and platform revenue at their peak only to have their Graph API endpoints throttled and eventually revoked in 2012 source.

Facebook’s decision wasn’t about privacy compliance so much as about safeguarding its own monetization engine and preventing a single partner from gaining too much influence over user retention and engagement. By closing off or limiting that partner’s deep hooks into friend referrals, in‑app notifications and viral loops, Facebook protected against revenue leakage (where a third party captures users’ attention and ad spend) and ensured that future growth and monetization experiments remained squarely under its control.

The opportunity we see for crypto social graphs

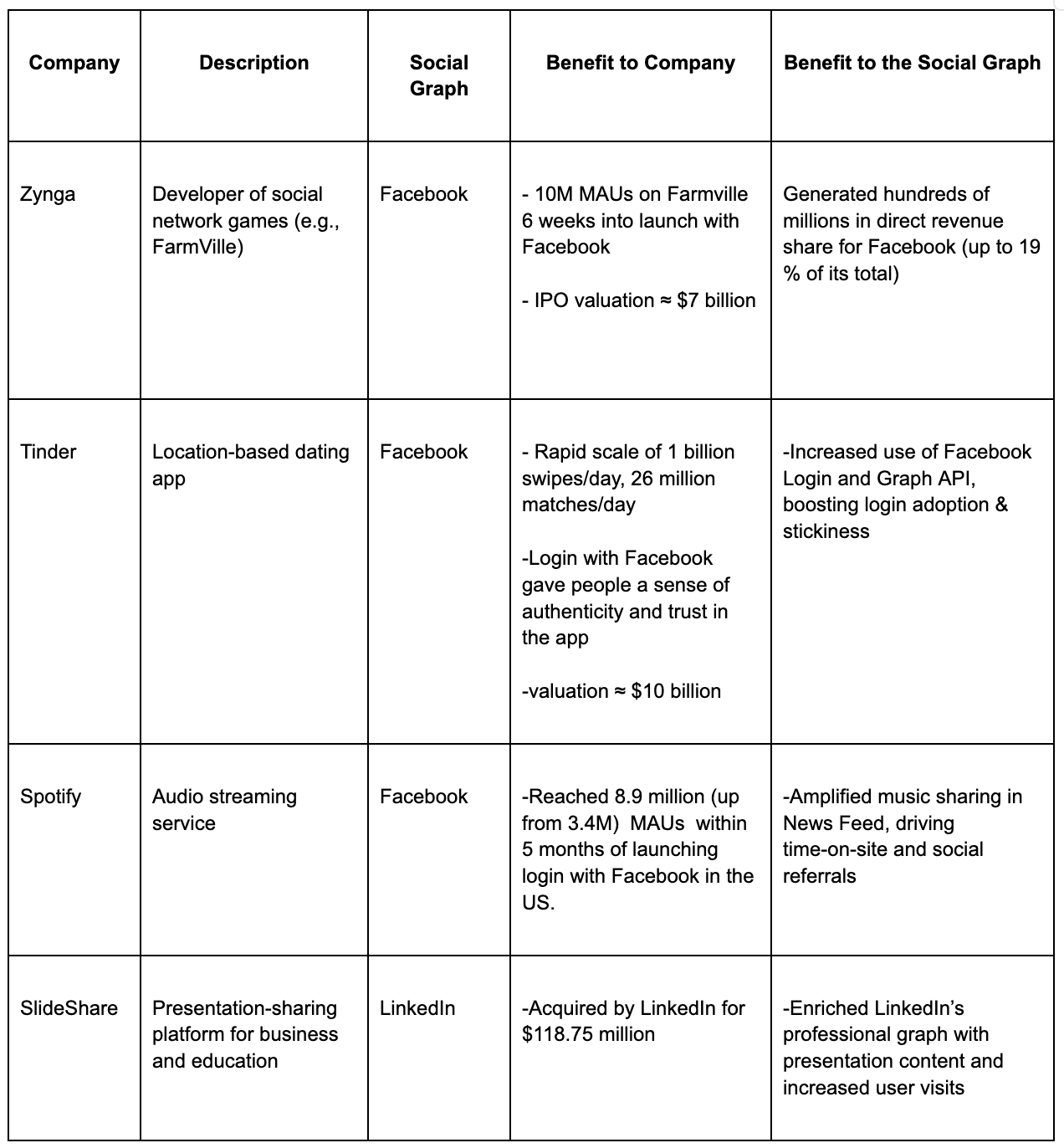

Web3 social graphs flip the power structure: they give users control over their identity and connections, developers the ability to build freely without fear of deplatforming, and introduce entirely new forms of interaction that weren’t possible in closed systems.

Decentralized (and open) social graphs are not just an alternative version of Facebook or Twitter. They are a 1000x leap in how the internet organizes relationships, ownership, and incentives.

User Ownership & Graph Portability. The shift starts with user ownership. In Web2, a creator with a million followers on Instagram has no way to take that audience elsewhere, their social capital is trapped. In Web3, relationships live on a shared, open graph, portable across apps and interfaces. A user who builds a following in one client can move to another without starting from scratch. This breaks the cycle of platform lock-in and forces product teams to compete on experience and innovation, not control.

Eliminating Platform Risk & Enabling Composability. For developers, open graphs eliminate platform risk. In Web2, many developers built value on top of social APIs, only to have access revoked once they became too successful, as happened with Zynga and Facebook. In contrast, decentralized social graphs are permissionless. Builders can create apps, clients, algorithms, and monetization tools with confidence that the underlying social layer won’t rug them. This creates fertile ground for a diverse ecosystem of applications from consumer clients and games to professional tools and curation layers.

Monetization. Web3 social graphs natively integrate payments into every interaction: minting content as NFTs, swapping tokens, and tipping creators all happen in-app, so every like, share, or comment can trigger a seamless microtransaction. By embedding token transfers directly into the UX, platforms create continuous, transparent revenue flows that reward creators and sustain network development.

New primitives for social graphs enabled by crypto

Most importantly, Web3 enables new social primitives that fundamentally reshape how people interact.

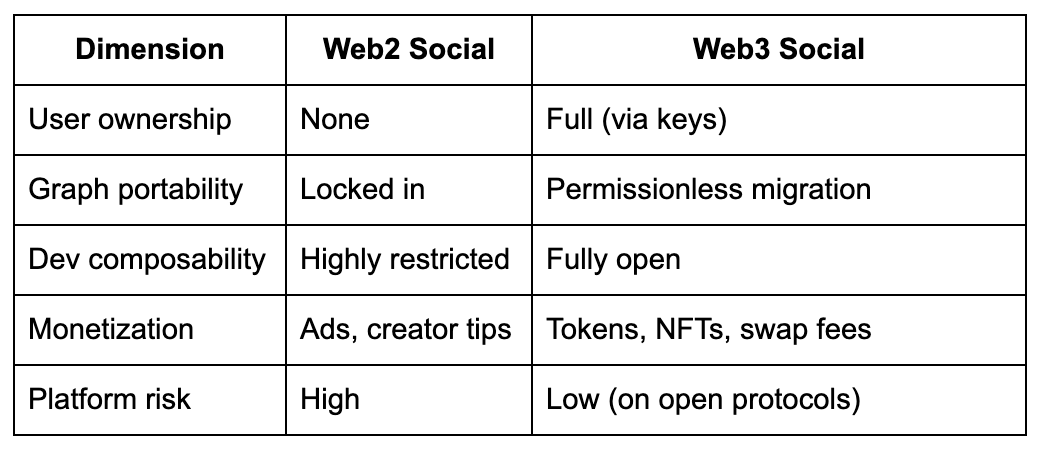

These include features like collecting, where users can mint posts or media as NFTs not just as a show of support, but as a new form of cultural ownership. “Collecting” becomes a way to express value, bet on emerging creators, or curate personal onchain archives.

Other primitives include tipping, staking on content, token-gated groups, and DAO-based governance. These mechanics move social networks from passive consumption to active economic participation, turning users into stakeholders and collaborators.

This isn’t just a better version of the status quo — it’s a step-function change. If successful, open social graphs will form the first shared social layer of the internet, allowing users, developers, and creators to co-own the networks they participate in. Much like Ethereum became the base layer for programmable value, decentralized social graphs could become the base layer for identity, culture, and coordination. This is not about marginal improvements, it’s about unlocking new digital behaviors and economic systems that simply couldn’t exist in Web2.

Bottlenecks of existing social graphs

While decentralized social graphs offer a powerful vision of user ownership and permissionless innovation, several structural bottlenecks continue to limit their success.

Slow User Growth and Narrow Appeal Most decentralized social graphs remain niche, struggling to expand beyond the cryptonative crowd. Despite the appeal of data portability and censorship resistance, these benefits have not translated into mainstream demand. Farcaster, for instance, has seen early success within EVM aligned crypto circles but remains concentrated in a narrow demographic.

Without breakout consumer use cases or culturally resonant products, developers face a cold start problem: the user base is too small to build sustainable apps, and the apps themselves aren’t yet compelling enough to drive significant growth.

Flagship App Dominance Protocol teams often launch their own first-party clients to bootstrap usage, but these apps frequently end up dominating user attention and capturing the majority of network value. Warpcast, Farcaster’s flagship client, exemplifies this dynamic: while it has been instrumental in driving early growth, it has also made it increasingly difficult for third-party clients to compete.

In mid-2024, there was a surge of interest in building Farcaster clients, with teams like Nook and Kiosk creating differentiated interfaces atop the Farcaster social graph, but momentum quickly stalled. Many of these teams have since paused development or pivoted entirely, citing a shared challenge: any traction they achieved ultimately funneled back to Warpcast, making it difficult to retain users or justify continued development.

Supercast, one of the most promising independent clients, was recently acquihired by Farcaster to help build out Warpcast itself. This move is part of a growing concern: the incentives between the Farcaster team and external developers remain misaligned. While the protocol may be open in theory, in practice the dominance of the first-party client continues to limit the ecosystem app diversity.

Weak GTM Execution Most protocols have treated go-to-market as an afterthought. Growth has been largely organic, driven by crypto-native narratives rather than deliberate distribution. But ideological alignment is not enough. Onboarding creators, communities, and mainstream users requires web2 level UX, thoughtful incentive design, and proactive GTM. Without them, Web3 social will remain an echo chamber of builders talking to builders.

Solving these constraints isn’t just necessary. It is the unlock for building durable, large-scale social networks that can finally challenge Web2 incumbents on product, not just principle.

The Current State of Decentralized Social Graphs

Despite raising significant venture capital, many social graph projects have either pivoted away from their original vision or ceased operations entirely. Today, only a handful of teams remain committed to building decentralized social graphs or products closely adjacent to them.

One of the earliest and most well-funded attempts was DeSo (formerly BitClout), which positioned itself as both a social graph and a Layer 1 chain purpose-built for social applications. Despite raising over $200 million, it currently averages around 500 daily active users, and lacks a meaningful app ecosystem.

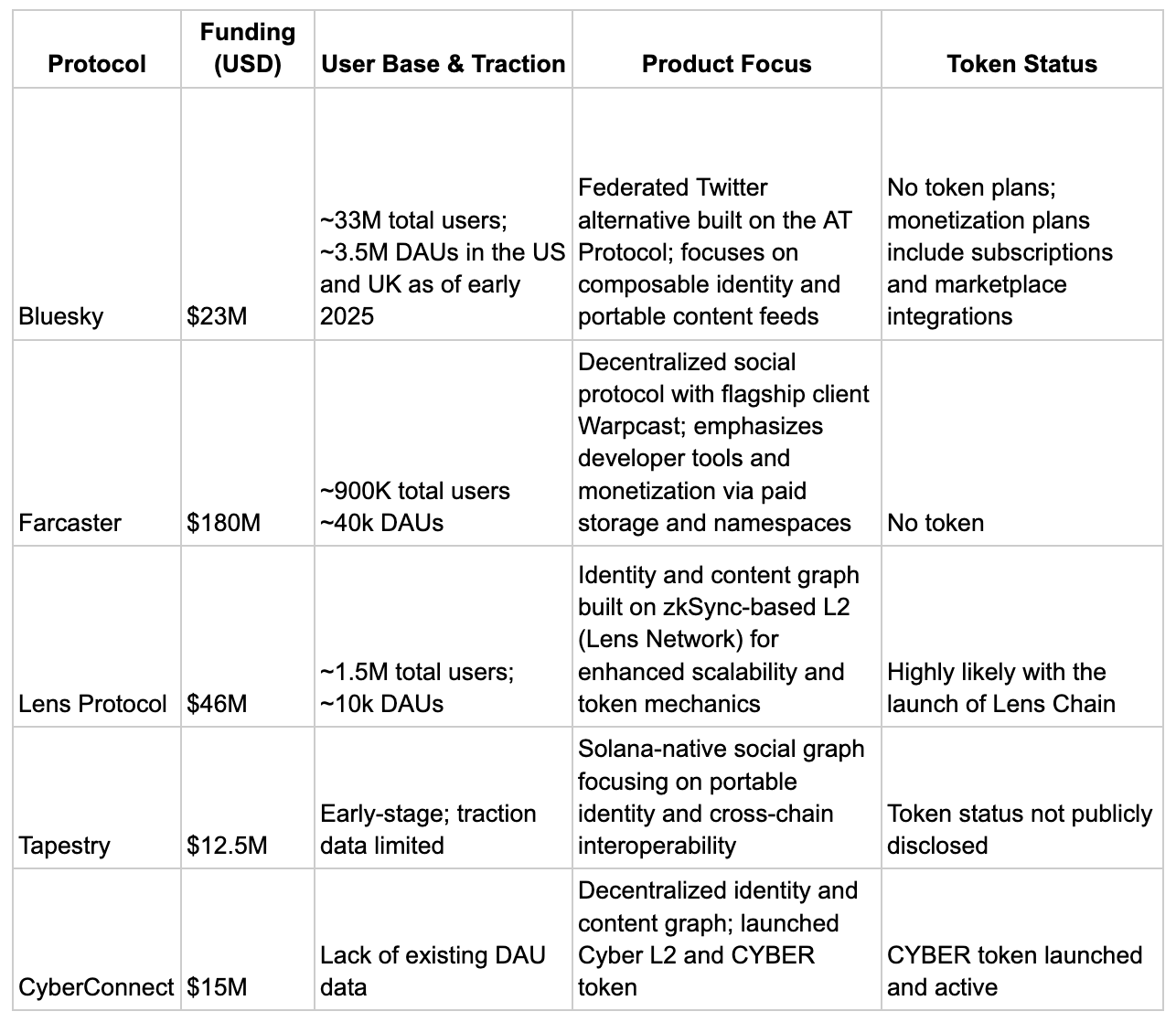

The few projects still actively building in the space include:

Despite raising hundreds of millions in venture capital, most decentralized social graphs struggled to reach escape velocity. Daily active users across protocols like Farcaster and Lens are still measured in the tens of thousands, which is extremely small compared to Web2 incumbents. Bluesky shows stronger momentum with millions of users, but much of that growth has been driven by external factors like Twitter's decline, not by introducing a new engaging consumer behaviour.

Some argue that the average revenue per user in crypto social is already higher than in Web2. While this may be directionally true due to early monetization features like paid storage, swap fees, NFT minting, and spending in mini apps, the data can be misleading. High ARPU on a small user base often reflects crypto-native behaviors, not sustainable monetization at scale. More importantly, it misses the real promise of open social graphs, which is to solve the cold start problem for developers.

Today, the promise of solving the cold start problem remains unfulfilled. Decentralized social graphs still fail to provide meaningful shared distribution, identity, or discovery that help new apps get off the ground. In most cases, developers are forced to build their own user bases from scratch. Rather than benefiting from the network, they compete with the flagship client for visibility and retention. This dynamic undermines the openness of the graph and limits ecosystem growth.

Until a social graph reaches scale with active users, meaningful retention, and successful third-party applications, its value remains theoretical.

What We’re Looking For in Social Graphs

At 1kx, we believe the next breakout social graphs won’t emerge from building an “onchain Twitter”. They will come from teams who deeply understand consumer behavior, build compelling products that users love, and leverage cryptonative mechanics to create entirely new forms of engagement, ownership, and coordination.

We’re looking for:

1. Breakthrough Consumer Apps That Create Net-New Behaviors

The strongest social graphs won’t start as protocols. They will start as products. Much like Facebook was originally about poking friends and Axie Infinity began as a game before becoming a chain, we believe the most valuable social graphs will emerge from sticky, high-retention consumer experiences. Whether it’s collecting, trading, or something entirely new, we want to back teams inventing the next crypto-native behavior, not retrofitting old ones. We are especially drawn to teams that understand timing and sequencing.

The strongest projects will lead with a focused, compelling app, and only open their social graph once critical mass is reached. As seen with Sky Mavis and Axie Infinity, starting with a product and expanding into a broader platform is far more effective than launching a neutral protocol out of the gate.

2. Founders Willing to Experiment With Tokenized Social Graphs

Tokenization remains underexplored in social, but the potential is massive. Early efforts like CyberConnect and Tapestry are encouraging starts in how can tokens become subsidised cac. We’re looking for teams willing to test new incentive models, launch coordinated airdrops, and treat tokens not as speculative instruments, but as core engines of growth, governance, and alignment.

There’s a lot to learn from play to earn gaming. These teams have embraced token incentives as a low-cost way to acquire users and bootstrap network effects. A standout example is Pixels, a game built on Ronin, which has reached $20 million in annualized revenue while maintaining a healthy in-game economy. Recent metrics show that 70 to 80 percent of player spending is now organic, compared to what they receive in token rewards. It’s a sign that we may be entering the era of sustainable token economies in gaming and we believe the same model can apply to social graphs.

3. Ability to Build Ecosystem

Great ecosystems aren’t built on grants. They’re built by solving real developer pain points like user acquisition, distribution, and network bootstrapping. We want teams that treat ecosystem building as a product problem, not a funding one, and who provide the infrastructure and reach needed to make third-party builders successful.

4. GTM Ability

Competing with Web2 requires more than good UX. Teams must know how to leverage tokens, community, and viral loops to break through. We’re looking for founders who understand how to align incentives across users, creators, and developers, and who can turn early activity into lasting network effects.

We believe the future of social graphs is user-owned, composable, and application-led. We back founders who know how to build momentum, understand where crypto unlocks new dynamics, and are ready to scale from product to protocol. We’re very excited about founders that look for their users in non web3 channels.

Conclusion

The social graph has always been the most powerful driver of online value, powering the rise of Web2 giants and enabling entire ecosystems of applications, content, and commerce. But the closed nature of those graphs has also limited what is possible. Developers get rugged, users are locked in, and value accrues to a small set of gatekeepers.

Decentralized social graphs represent a reset. They offer the opportunity to rebuild this foundational layer of the internet in a way that is open, user-owned, and permissionless by design. We are still early, but the pieces are beginning to come together: new consumer behaviors like collecting and trading, token incentive models inspired by gaming, and app-first founders building sticky products that can evolve into platforms.

This is not just a bet on infrastructure. It is a bet on a new kind of internet where social capital is portable, developers can build without fear, and users participate in the upside of the networks they help create.

At 1kx, we are here to back the teams who will make that future real.

Believe in something.

Disclaimer: This article is for general information purposes only and should not be construed as or relied upon in any manner as investment, financial, legal, regulatory, tax, accounting, or similar advice. Under no circumstances should any material at the site be used or be construed as an offer soliciting the purchase or sale of any security, future, or other financial product or instrument. Views expressed in posts are those of the individual 1kx personnel quoted therein and are not the views of 1kx and are subject to change. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell or a solicitation of an offer to buy any securities, and may not be used or relied upon in evaluating the merits of any investment. All information contained herein should be independently verified and confirmed. 1kx does not accept any liability for any loss or damage whatsoever caused in reliance upon such information. Certain information has been obtained from third-party sources. While taken from sources believed to be reliable, 1kx has not independently verified such information and makes no representations about the enduring accuracy or completeness of any information provided or its appropriateness for a given situation. 1kx may hold positions in certain projects or assets discussed in this article.