Kaia and How a Defensible Distribution will Bring Crypto to the Masses

by Nichanan KesonpatPUBLISHED Apr 30, 2025

Our thesis on Kaia, and why its distribution through Asia’s largest superapps positions it to drive crypto mass adoption.

Blockchains often differentiate technically and and compete for the same set of users and devs, with mercenary capital moving from one highly anticipated mainnet launch to the next, leaving their apps struggling to find a sustainable user base.

While this go to market works well for first movers, we believe it is now a red ocean strategy.

At 1kx, we’ve instead been trying to find opportunities that can expand the TAM of developers and users with a real world distribution advantage instead.

This is when Kaia came into the picture.

Kaia launched on mainnet in August 2024 as a merger of the Klaytn and Finschia, blockchains developed by Asia giants Kakao and LINE. Both projects reached moderate success in their own right, with Klaytn generating over 1 billion transactions from over 300 dapps spanning across DeFi, RWAs, entertainment, and participation in the Bank of Korea’s Central Bank Digital Currency (CBDC) pilot project. Finschia integrated with LINE's users and offered services like a non-custodial wallet and an NFT platform.

This merger gives Kaia an exclusive partnership and native integrations with KakaoTalk and LINE Messenger, daily-use platforms for hundreds of millions of users, a distribution advantage in the Asian market unlike that of any other ecosystem. For the first time, web3 developers can reach a previously untapped demographic of mobile-first, non-cryptonatives in a region which ranks among the highest in mobile engagement and spend. Less than 3 months since the launch of Kaia’s Mini Dapp ecosystem, it is now the #1 most active EVM chain by Daily Active Addresses, with the top performing dapps achieving an Average Revenue Per Paying User (ARPPU) of up to 3x higher than reached on other platforms.

Unparalleled Distribution Through Asia’s Leading Superapps

To fully appreciate the reach that Kaia apps have through KakaoTalk and LINE, we first need to understand the nature of superapps and how deeply integrated they are in the lives of individual users and businesses. Unlike the fragmented mobile app ecosystem in the West, where communications, banking, mobility, and entertainment are dominated by different players, in Asia these services are offered in one “superapp” owned by a single entity and their subsidiaries.

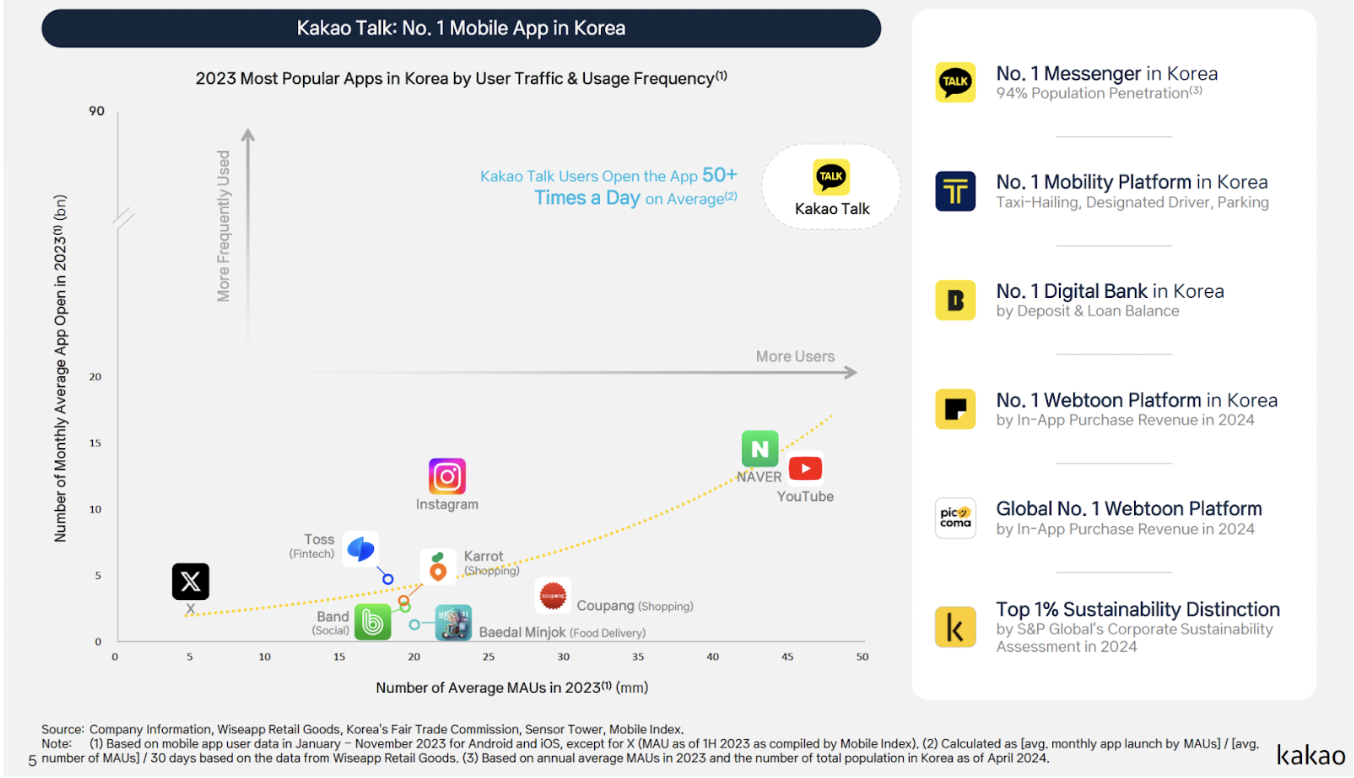

KakaoTalk is the leading messenger app in South Korea with 49 million MAU. South Korea has a 52 million population, which means KakaoTalk accounts for nearly 95% of messaging app usage in South Korea. KakaoTalk users open the app over 50 times a day on average, dwarfing the usage of platforms like X, YouTube, and Instagram in the region. This dominance is underpinned by integrations with services like KakaoPay (payments), Kakao T (mobility, parking), and KakaoBank (internet banking), making it a daily necessity for South Koreans. Each of Kakao’s platform services are the leader in their respective categories.

Source: Kakao Q4 2024 Earnings Report

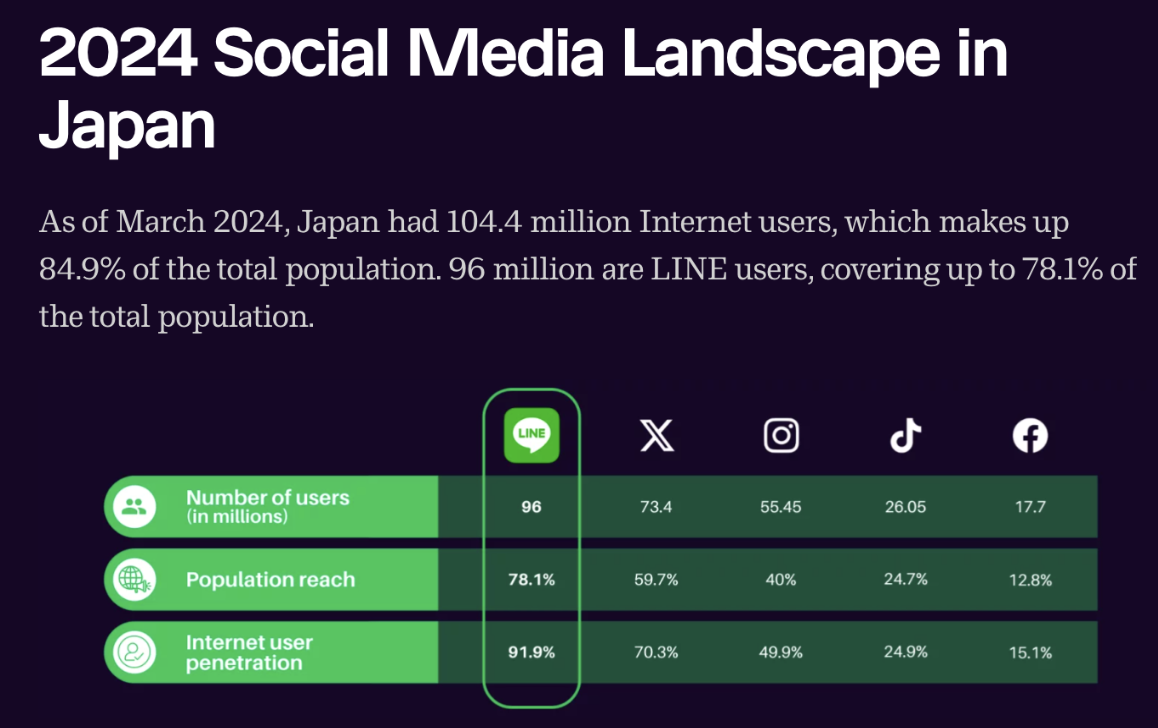

Meanwhile, LINE is one of the leading superapps in Southeast Asia and the 8th ranking social media app worldwide. With over 196 million monthly active users, LINE dominates with 70-90% penetration across smartphone users in Japan, Taiwan, and Thailand. Its platform extends beyond messaging to digital payments (LINE Pay), gaming (LINE Games), digital comics (LINE Webtoon), extensive sticker ecosystem (LINE Friends), and free voice/video calls.

Source: Digital Marketing for Asia

In 2024, 85% of Thai internet users were on LINE and the country consistently ranks high in hours spent on mobile apps (with games and video streaming being popular activities). In Taiwan, 92% of people aged 15–65 used LINE in the past week (as of 2024), and half of them check the app ~14 times daily.

Together, KakaoTalk and LINE provide Kaia access to over 250 million users across Asia’s key markets. Excluding China and WeChat, Kaia’s serviceable obtainable market accounts for 80% of digital consumption and spending in Asia, where users are already habituated to discovering games, services, and shopping within these apps. Any dapp or service built on Kaia can be seamlessly introduced to this audience without needing to onboard from scratch.

Meeting Highly Engaged Consumers Where They Are

Kakao and LINE penetration makes them indispensable tools for businesses to reach their audiences. Kaia’s native integration into these platforms means developers will be launching their dapps onto fertile ground. Not only is the audience already highly engaged, the user lifetime value for mobile gaming in these regions is among the highest globally.

Kaia’s infrastructure and UX have been optimized to minimize onboarding friction and the complexities of blockchain interaction, with the simple hypothesis that as long as they can deliver delightful content and experiences to this user base, users will be willing to engage with and play for them just like they already do with any other application. We are seeing this effort bear fruit in its first months.

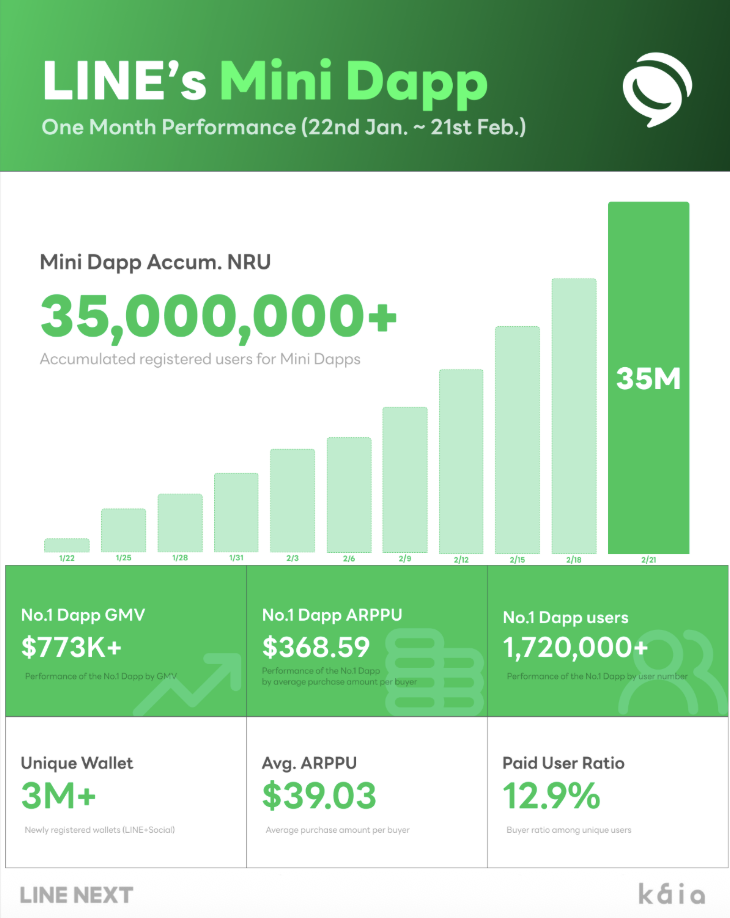

Proven Willingness to Spend. Users in Asia, particularly Japan and Korea, spend heavily on digital goods (characters, skins, stickers). If dapps are made easily accessible, many users will spend on them as they would on any mobile game. Kaia is already seeing evidence of this – after launching Mini Dapps on LINE, the top dapp earned ~$773,000 in revenue in its first month.

High Engagement = High Conversion Potential. KakaoTalk and LINE’s penetration ensures Kaia-powered dapps high visibility. In the first month of LINE’s Kaia Mini Dapp portal going live (Q1 2025), 35 million accumulative user sessions and 3+ million wallets were created by users across Japan, Taiwan, Thailand, and Korea.

Bridging Non-Crypto Users. Kaia’s end-to-end integration from wallet creation to frictionless payment within the messengers lowers the barriers that typically hinder mainstream users from onboarding to web3. In its first month, 32% of payments for LINE’s Mini Dapp items were made via credit cards (fiat) rather than crypto. The ability to engage non-cryptonative consumers on their terms is key to mass onboarding, leveraging the trust and habit users already have in LINE and Kakao.

Source: LINE Corp

Focus on High Quality Dapps and Sustained Growth

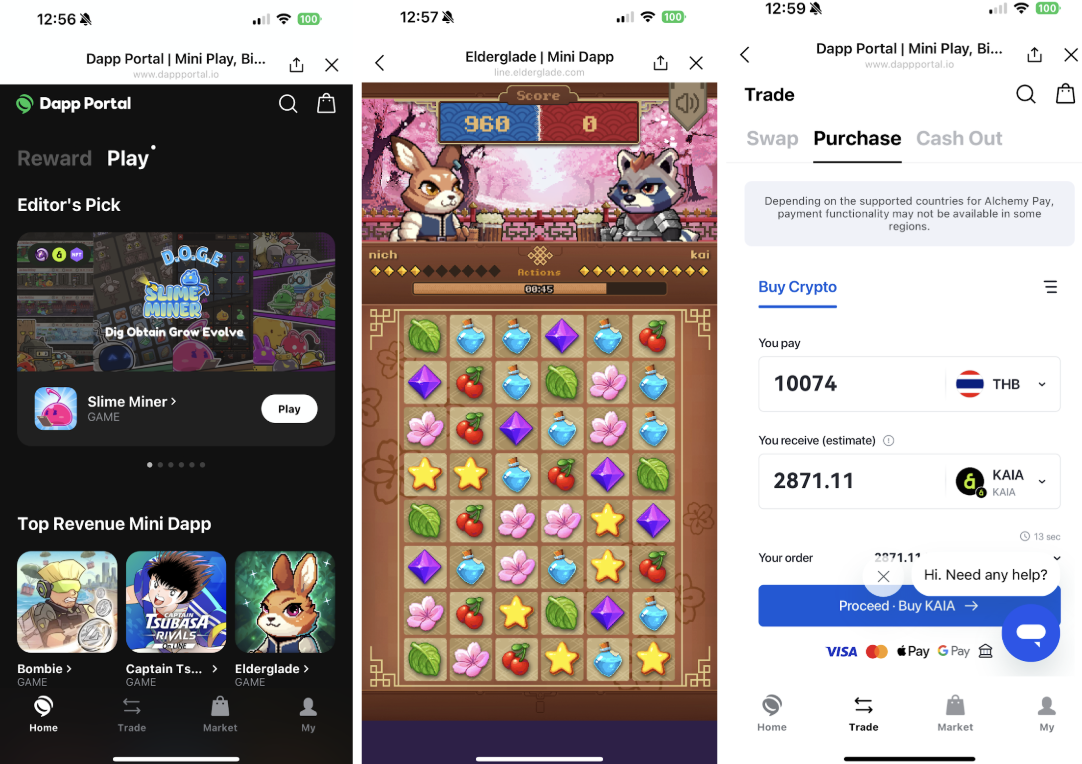

Since Kaia’s user base and regional consumer behavior are well understood, Kaia can tailor its app ecosystem to user preferences from Day 1. For example, Japan has a strong affinity for unique animations and IPs, while Taiwan is among the top consumers of RPG games. Kaia’s initial cohort of apps already span a range of genres—RPG, action, idle, defense—and IPs offering a much more engaging experience than simple tap-to-earn and farming mechanics.

As the majority of these users are non-cryptonatives, the quality and diversity of apps and intuitive UX are key over short-term speculation. This means minimizing crypto friction, translating game and community content for regional audiences, and providing clear onboarding flows that help users understand what to do, how to earn, and how to level up their engagement.

Kaia Wave, the builder support program in collaboration with LINE NEXT ensures such onboarding ease and frictionless UX within LINE. The program also offers marketing support through:

LINE Official Account (OA) Push Notifications: Messages will be sent to LINE’s users about new Mini Dapp and features, with a path that eases them into web3 without dealing with complex wallet infrastructure.

Targeted Marketing with LINE Ads: Direct exposure for Mini Dapps on LINE’s ad pages allows dapps to efficiently run ads targeting specific regions, which should prove more cost-effective than traditional crypto customer acquisition costs (CAC).

Users can Discover, Play, and Swap/On-Off Ramp without leaving LINE

For projects that have launched on other mini dapp platforms like TON, Kaia is a clear strategic move to broaden their reach to a highly differentiated user base who are less cryptonative but already exhibiting more sustained engagement and higher spend.

Launching on KAIA has been a major milestone for us in terms of measurable growth. Since our official launch in February, Boxing Star X has onboarded over 700,000 users through the LINE Mini App platform. That scale of user acquisition, especially from previously untapped markets, has been a game-changer for our ecosystem.

Retention metrics between Telegram and LINE are relatively consistent, which is a strong signal considering the different levels of crypto fluency across the platforms. What’s particularly exciting is the revenue performance: our daily ARPPU (Average Revenue Per Paying User) on KAIA averages around $111 USD, which is significantly above typical benchmarks for mobile and web3 games. Japan, in particular, stands out as the highest contributing market in terms of ARPPU, validating our efforts to localize and optimize for LINE’s core demographics.

BoxingStarX

The most significant performance metric is our ARPPU on Kaia reaching $319. This has translated to substantial revenue expansion during our initial operational period on the platform. These performance indicators validate our platform diversification strategy and illustrate the considerable potential within the Kaia ecosystem.

Barry, Bombie COO

Traction so Far, and What’s To Come

Kaia’s Dapp Portal launched in January 2025 with 32 apps. Today, there are

64 dapps onboarded out of 800 projects that have applied so far

41 million unique users

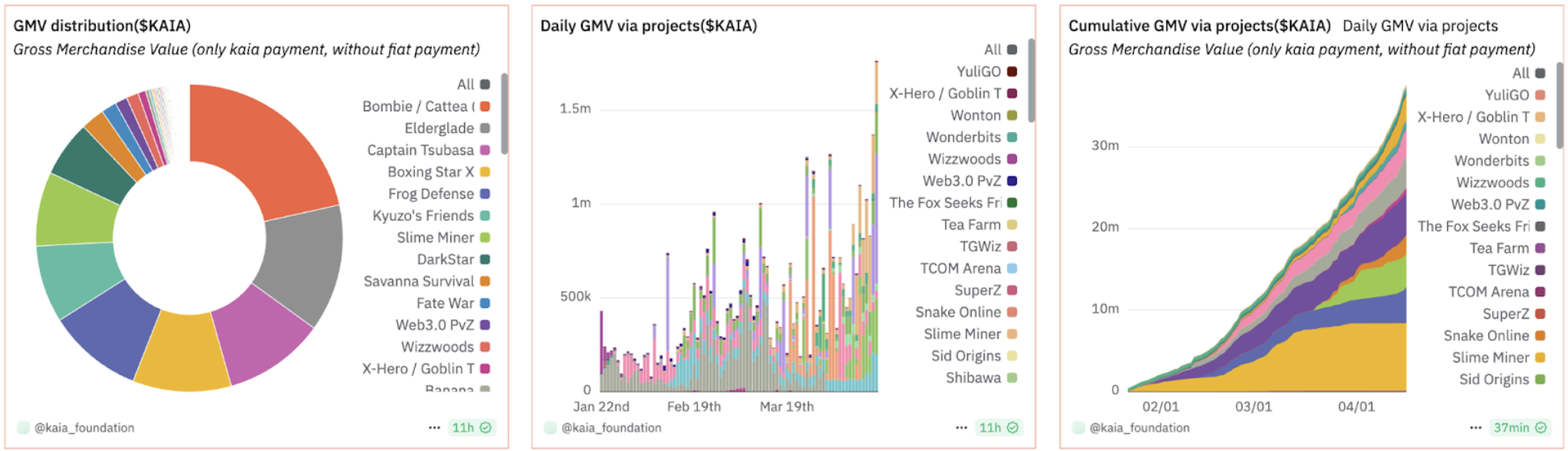

$6.3 million (54m $KAIA) Total GMV - excluding fiat payments

$790k (6.7m $KAIA) Avg GMV of the Top 3 dapps - excluding fiat payments

$1.7k (15k $KAIA) Avg ARPPU of the Top 3 dapps - excluding fiat payments

3m Daily Active Accounts - making it the most active EVM chain in terms of 30-day Unique Active Addresses

https://dune.com/kaia_foundation/kaia-wave

With a strong wedge through games, Kaia is poised to not only be a blockchain for Mini Dapps but a fully fledged application platform with integrated onchain services. Just like how KakaoTalk and LINE users rely on the app not only for messaging but day to day mobility, entertainment, and payments, Kaia users can seamlessly onboard to to the Mini Dapps available today and eventually funnel onto DeFi, NFTs, and other web3 products.

Kaia’s expansion into more cryptonative products and services are already in motion.

Native Stablecoin Integration. This marks the first major milestone of Kaia’s DeFi ecosystem. Starting in April, users will be able to deposit USDT and earn yield in just a few clicks directly on LINE. For Japanese users—who face extremely low interest rates and have strong demand for USD-denominated investments—this presents a highly attractive opportunity.

Curated DeFi Protocols. The team is currently in the selection stage for high-quality teams in each DeFi sector of lending, perp DEXs, payments, derivatives, and delta-neutral and RWA-backed yield products - with the first protocols launching in Q3.

KRW <> USDT Payment Infrastructure. Starting with its Korean users, Kaia will partner with local payment processors to ensure frictionless conversion between fiat and USDT. This will accelerate crypto’s adoption in commerce, bridging day to day activity with the onchain ecosystem.

When It Comes to the Application Layer, A Defensible Top of Funnel is King

Centralized exchanges (CEXs) have been the most successful applications to onboard users onto crypto as they enable users to achieve the simple, most common goal of buying, holding, and trading tokens. Out of the hundreds of millions of users that have onboarded via a CEX, only a fraction of those funnel into self-custody wallets to explore use cases beyond trading. However, in each cycle we see waves of new users enter to take advantage of opportunities not offered to them by a CEX.

DeFi (2020 - 2021)

NFTs (2021 - 2022)

Ordinals (2023)

Memecoins (2023 - 2024)

Points/Airdrop Farming (2023 - 2024)

For these use cases, users funnel down to what is currently the second most widely adopted category of applications: wallets. Wallets have in turn come to own the user relationship and therefore have a lot of leverage over protocols, data infrastructure, and other services such as on/off-ramps and security tools. For the winners, they can also be lucrative businesses, with Metamask generating over $320 million in Swaps revenue since its launch.

Over the past 5 years, we have seen a massive proliferation in wallets, with each new product targeting underserved chains, regions, and use cases (memecoins, stablecoins, NFTs etc.), and promising superior UX to its incumbents. And yet, the top wallets today are still CEX-affiliated (Trust, Coinbase, OKX) due to their defensible top of funnel via the parent exchange.

More recently, embedded wallets and account abstraction have turned web3 onboarding on its head. Instead of having to download third-party wallets and acquire gas tokens, users no longer have to navigate away from the primary app before making their first onchain actions, massively reducing churn by giving developers more control of their UX. Wallet SDKs such as WalletKit, Privy, and Dynamic have carved out an entirely new product category that enables apps to massively onboard users without having to rely on the broader adoption of tokens or self-custody wallets.

We therefore believe that the products that will onboard the next wave of crypto users and best poised to capture value are no longer CEXs or standalone wallets but applications themselves. While there has been a proliferation of new chains competing to host them, the most lucrative application platforms will be those that offer maximum reach to new audiences from Day 1. Kaia stands out as a highly differentiated application platform whose distribution and execution so far puts it ahead of the pack.

Conclusion

With each cycle, the crypto industry has been chipping away at new use cases and infrastructural developments that make decentralized applications ready for mass adoption. Scaling technologies have made transactions fast and cheap, embedded wallets remove onboarding friction, and payment infrastructure is making crypto interoperable with the rest of the financial ecosystem. The missing piece for new applications has been distribution and the ability to meet users where they are.

Kaia’s traction and the metrics it has delivered to dapps so far provide a glimpse into how powerful a defensible top of funnel can be. As developers look to expand their user base beyond cryptonatives, it will be impossible to overlook the only ecosystem that immediately puts their products in front of hundreds of millions of engaged users.

Disclaimer: This article is for general information purposes only and should not be construed as or relied upon in any manner as investment, financial, legal, regulatory, tax, accounting, or similar advice. Under no circumstances should any material at the site be used or be construed as an offer soliciting the purchase or sale of any security, future, or other financial product or instrument. Views expressed in posts are those of the individual 1kx personnel quoted therein and are not necessarily the views of 1kx and are subject to change. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell or a solicitation of an offer to buy any securities, and may not be used or relied upon in evaluating the merits of any investment. All information contained herein should be independently verified and confirmed. 1kx does not accept any liability for any loss or damage whatsoever caused in reliance upon such information. Certain information has been obtained from third-party sources. While taken from sources believed to be reliable, 1kx has not independently verified such information and makes no representations about the enduring accuracy or completeness of any information provided or its appropriateness for a given situation. 1kx may hold positions in certain projects or assets discussed in this article.