Lit Protocol was built to be a foundational building block of the open, user-owned web. As the first decentralized and programmable key management infrastructure, Lit removes the burden on developers to manage keys and cryptography, allowing key material and compute to remain private and under users’ control. For years, Lit has served as a core primitive for signing and encryption, demonstrating use cases across the web3 ecosystem and traditional enterprises alike. In this article we dive into how Lit becomes the critical enabler for the next generation of applications on the open internet.

Robust key management becomes even more crucial with the proliferation of blockchains, VMs, and the intersection of crypto x AI. Lit’s decentralized network uniquely enables the next generation of trust-minimized, censorship resistant applications in autonomous decentralized finance (DeFAI), crosschain/VM orchestration, and privacy-preserving AI.

Lit provides builders a comprehensive tool suite for managing keys and performing generalized, private compute actions. Developers can build apps that span across blockchains and offchain systems while maintaining a level of security and trustlessness currently unavailable in traditional key management and trusted custodial systems.

This positions Lit to facilitate the rapidly evolving developments in:

DeFAI (DeFi + AI). Agents are increasingly being used to manage complex financial strategies and execute trades across multiple protocols. Decentralized key management provides guarantees that users retain full control over their agents’ identities and access.

Crosschain / CrossVM Operations. User experience has become fragmented with the proliferation of blockchain networks. Applications need robust interoperability infrastructure that orchestrates liquidity and solves user intents to give users access to assets on multiple chains instantly.

Data Sovereignty. With the rise of decentralized data marketplaces and private inference, decentralized encryption and access control infrastructure are essential for ensuring data privacy and security in AI-driven applications.

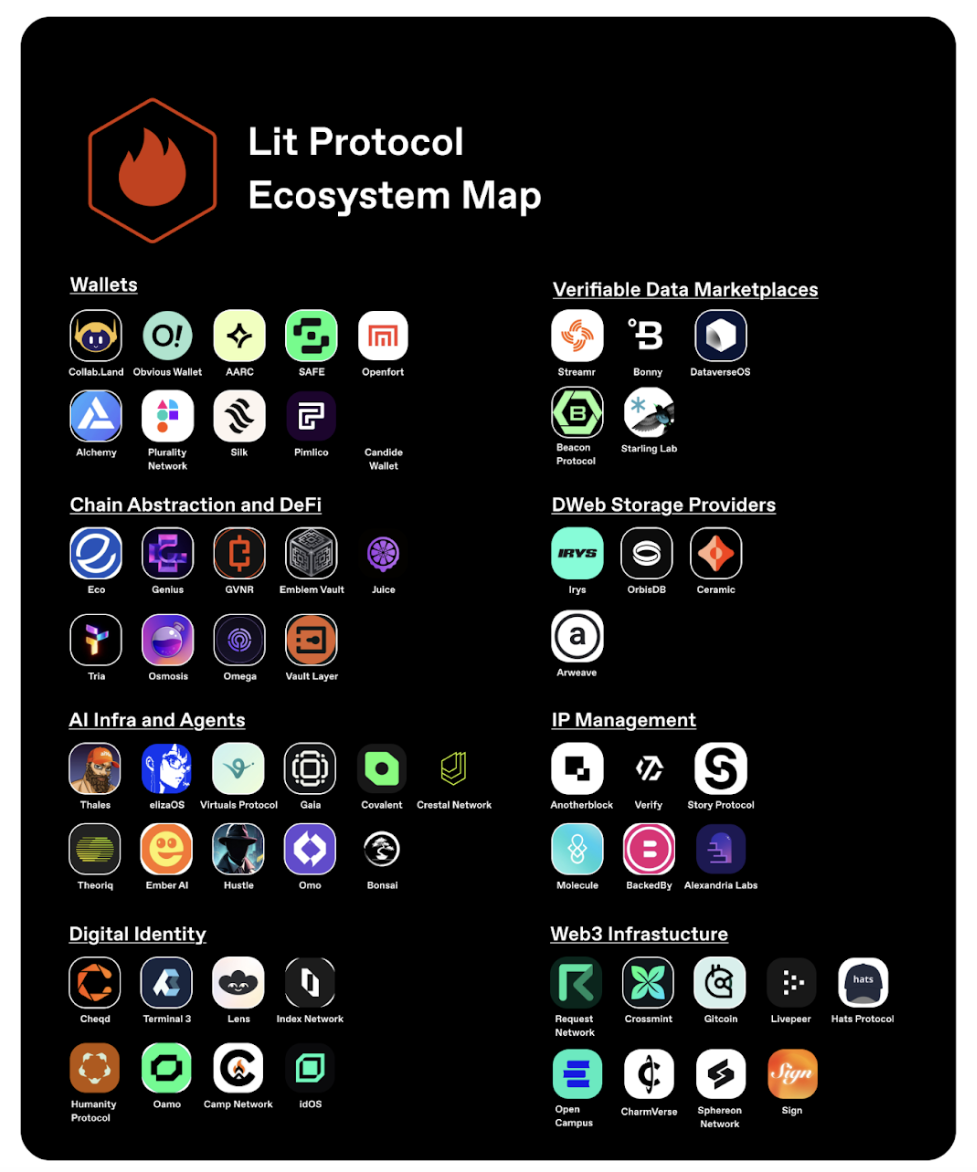

The Lit Protocol Ecosystem spans apps and protocols building user wallets, autonomous agents, blockchain interoperability solutions, digital identity platforms, and more:

Lit’s Core Products

Decentralized Key Management. Lit Protocol combines Multi-Party Computation Threshold Signature Schemes (MPC + TSS), and Trusted Execution Environments (TEEs) whereby “shares” of a private key are distributed among a network of nodes. Each key share is stored in a sealed, encrypted VM. The complete key never exists in its entirety, nor do the parts leave its encrypted VM. These keys operate on signing and encryption policies which are enforced by the protocol.

Private Compute. Lit Actions serve as the programmable policy layer that dictates the logic Lit keys use to perform signing and encryption / decryption operations. Here, developers can run private logic over encrypted data.

Autonomous DeFi needs decentralized key management

DeFi has established itself as a core use case of crypto, with onchain money markets and decentralized exchanges serving as a backbone for downstream consumer and enterprise applications. The introduction of AI opens up an even larger opportunity for automation, yield optimization, and risk management. DeFAI agents provide another abstraction layer and interface for end users to participate onchain.

However, most agents today are built such that the developer has entire access to or control over an agent's private key, effectively acting as custodians of the agent's assets. This contradicts the decentralized ethos of Web3 and DeFi, introducing risks associated with delegating permissions to centralized entities.

Lit’s Agent Wallet secures agents' private keys and secrets within a decentralized network. The TEE provides integrity for LLM inference, while MPC signing enhances security and liveness guarantees. This is being utilized by agents such as Hustle and Bonsai. By ensuring that no single external entity can control an agent's identity, data, or decision-making process, Lit enables truly autonomous and unstoppable agents.

Programmable signing breaks down barriers between previously isolated networks

The proliferation of rollups and appchains have enabled new types of web3 applications to go to market where previously unfeasible with mainnet gas costs and blocktimes. While this is a UX win from a singular application’s perspective, liquidity and the wallet experience have become fragmented across the multichain ecosystem. In recent years, chain abstraction solutions have come to market to aggregate liquidity and abstract the process of bridging from the end user.

Lit is uniquely positioned to serve such interoperability across a broader variety of blockchain networks. Its flagship programmable key pairs (PKPs) support chains using ECDSA, and the newly launched Wrapped Keys feature extends support to non-ECDSA chains as well, extending support beyond EVM chains and Bitcoin to ecosystems like Solana as well.

Lit’s chain signatures and generalized message passing have been adopted for both financial and chain-abstracted user onboarding use cases. Tria’s Abstraction SDK utilizes Lit to handle user auth and wallet creation, as well as to sign and execute transactions across supported chains. Genius, is an onchain exchange that utilizes programmable keys from Lit for liquidity orchestration across chains and asset types. Thales is a trading agent that integrates Lit for cross-chain transaction signing and Shogun SDK for performing swaps and bridging across chains.

Tackling data sovereignty and privacy-preserving AI

As AI adoption accelerates across industries, data privacy, security, and ownership become even more crucial. Traditional AI models often require access to vast amounts of personal or proprietary data, creating significant risks around unauthorized access, regulatory non-compliance (GDPR, CCPA), and centralized control over sensitive information.

Furthermore, enterprises and individuals increasingly demand privacy-preserving AI solutions that allow computations to be performed on encrypted data without exposing raw inputs—ensuring confidentiality while still enabling powerful machine learning applications.

This creates tailwinds for Lit’s core decentralized access control product, where developers can grant or revoke access to sensitive data on- and offchain based on predefined conditions. Despite its nascency, the protocol has already been adopted by large cryptonative projects (Lens, Streamr) and traditional enterprises (Fox Corporation) alike.

Towards the Autonomous Cloud

Cryptographic keys have long served as an access point to both centralized and decentralized systems. As we move towards an “agentic web” in which humans interact with a singular interface that coordinates tasks and services on their behalf via agents, the need for trust-minimized key management infrastructure is bigger than ever before.

Since its mainnet beta launch in February 2024, Lit Protocol has grown to secure approximately $100,500,000 in assets and has fulfilled over 15 million encryption, signing, and compute requests. Lit Action usage (total network requests) is growing at a rate of 300% month-over-month. Lit facilitates a strong ecosystem of over 70 projects building on its infrastructure, demonstrating a meaningful wedge in encryption and signing.

Lit’s traction so far only encapsulates its role as a method, providing encumbered API keys and signature verification from TEEs through its signing and encryption SDK. Despite ample room to grow here, the larger untapped opportunity lies in using Lit Actions to allow AI agents to perform private inference over encrypted data (LLM compute). In both cases, each signing and decryption request as well as LLM prompting drives value to the network, as users will need LIT tokens to pay for its services.

As AI agents continue to drive an increasingly larger portion of onchain activity, Lit’s Agent Wallet equips developers with secure tools to build for autonomous DeFi. The wallet integrates with elizaOS, the most popular agent framework, enabling onchain permissioning systems for agents. This presents the network with an additional value capture potential on swaps and yield facilitated by agents, which at the time of writing is at 15 billion in daily volume.

Conclusion

Over the past 4 years, our deep dives on wallet infrastructure, decentralized identity, and DAO tools have featured Lit Protocol, showcasing the diversity of its application, with developers using Lit to build data marketplaces, chain abstracted liquidity protocols, smart wallets for Bitcoin, as well as private data systems for individuals and organizations.

Lit Protocol’s unique approach to key management, as well as its focus on developer experience and ecosystem growth positions it to be the foundational layer for decentralized, cryptographically verifiable systems. In the upcoming months we can expect to see the rollout of Lit’s LLM tools that enable AI agents to perform more complex tasks, as well as Fully Homomorphic Encryption (FHE) keys that will enable the protocol to provide enhanced privacy and security across a wider range of secrets. We are extremely proud to be early supporters of the team, and are excited to see Lit solidify its place at the intersection of crypto and AI.

Disclaimer: This article is for general information purposes only and should not be construed as or relied upon in any manner as investment, financial, legal, regulatory, tax, accounting, or similar advice. Under no circumstances should any material at the site be used or be construed as an offer soliciting the purchase or sale of any security, future, or other financial product or instrument. Views expressed in posts are those of the individual 1kx personnel quoted therein and are not the views of 1kx and are subject to change. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell or a solicitation of an offer to buy any securities, and may not be used or relied upon in evaluating the merits of any investment. All information contained herein should be independently verified and confirmed. 1kx does not accept any liability for any loss or damage whatsoever caused in reliance upon such information. Certain information has been obtained from third-party sources. While taken from sources believed to be reliable, 1kx has not independently verified such information and makes no representations about the enduring accuracy or completeness of any information provided or its appropriateness for a given situation. 1kx may hold positions in certain projects or assets discussed in this article.